All-in-One Investment Toolkit

All-in-One Investment Toolkit

All-in-One Investment Toolkit

Equity in minutes, not weeks

All your investment tools in one place — create a funding round, invite investors and manage compliance with ease.

How VelaFund works

Step 1

Create a funding round

Create a funding round with a contract template in under 5 minutes.

Step 2

Investors contribute

Investors signup via a link, sign the participation contract and make their investment.

Step 3

Easy compliance

Compliance documents for you and your investors generated automatically.

How VelaFund works

Step 1

Create a funding round

Create a funding round with a contract template in under 5 minutes.

Step 2

Investors contribute

Investors signup via a link, sign the participation contract and make their investment.

Step 3

Easy compliance

Compliance documents for you and your investors generated automatically.

How VelaFund works

Step 1

Create a funding round

Create a funding round with a contract template in under 5 minutes.

Step 2

Investors contribute

Investors signup via a link, sign the participation contract and make their investment.

Step 3

Easy compliance

Compliance documents for you and your investors generated automatically.

Coordinate with investors in real time.

Coordinate with investors in real time.

Track your fundraising, share info about your company with investors and update them regularly. All with compliance built-in.

Track your fundraising, share info about your company with investors and update them regularly. All with compliance built-in.

Smart Dashboard

See all your funding rounds, investors, share price and current valuation in one place.

Smart Dashboard

See all your funding rounds, investors, share price and current valuation in one place.

Smart Dashboard

See all your funding rounds, investors, share price and current valuation in one place.

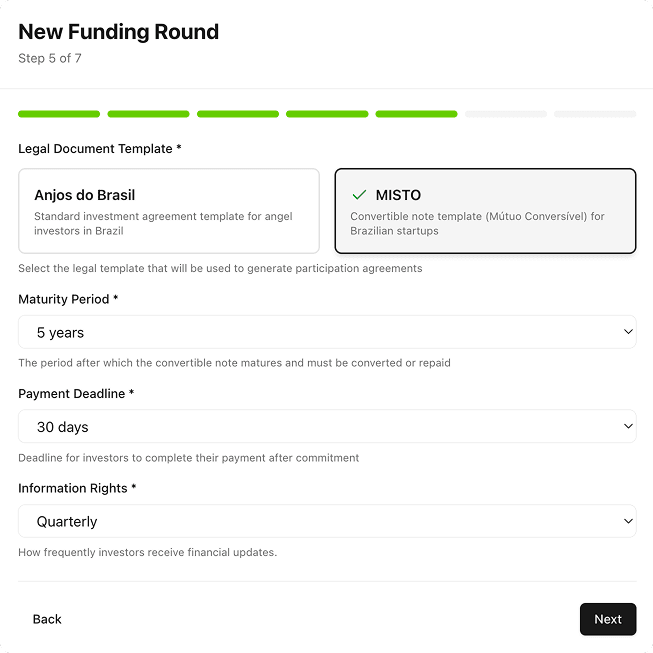

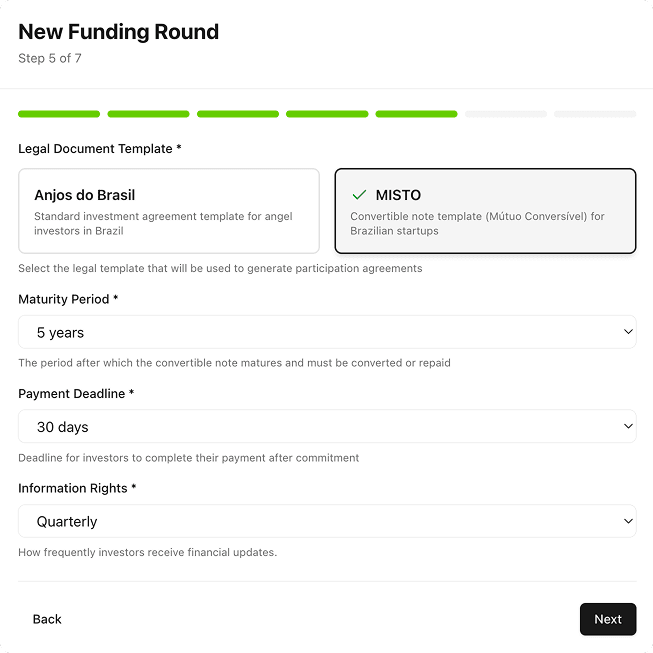

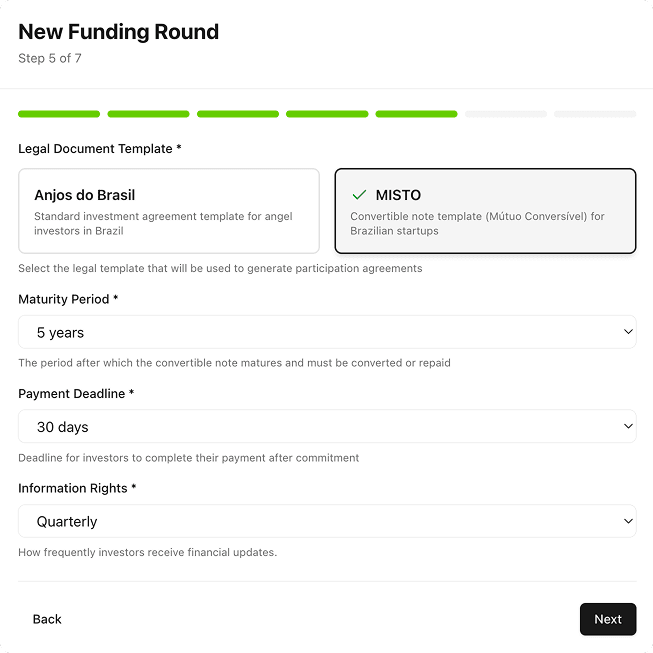

Contract Generation

Create an investment contract using the most popular templates.

Contract Generation

Create an investment contract using the most popular templates.

Contract Generation

Create an investment contract using the most popular templates.

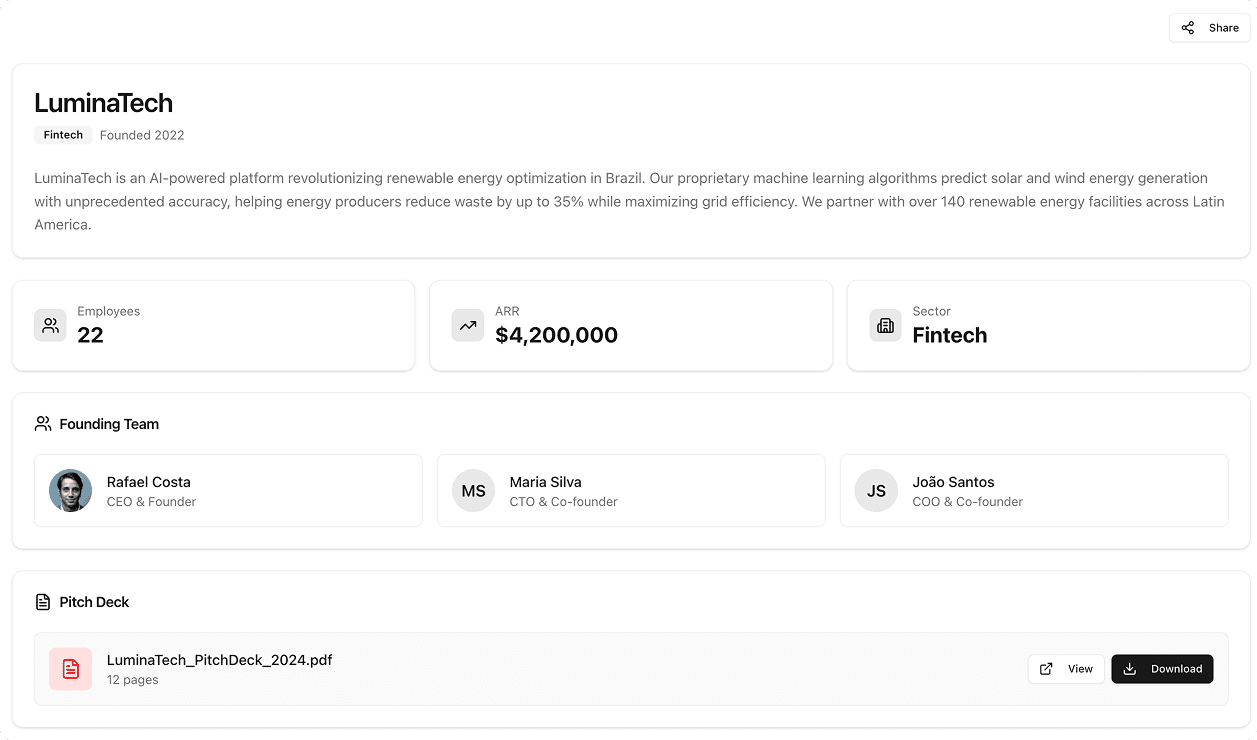

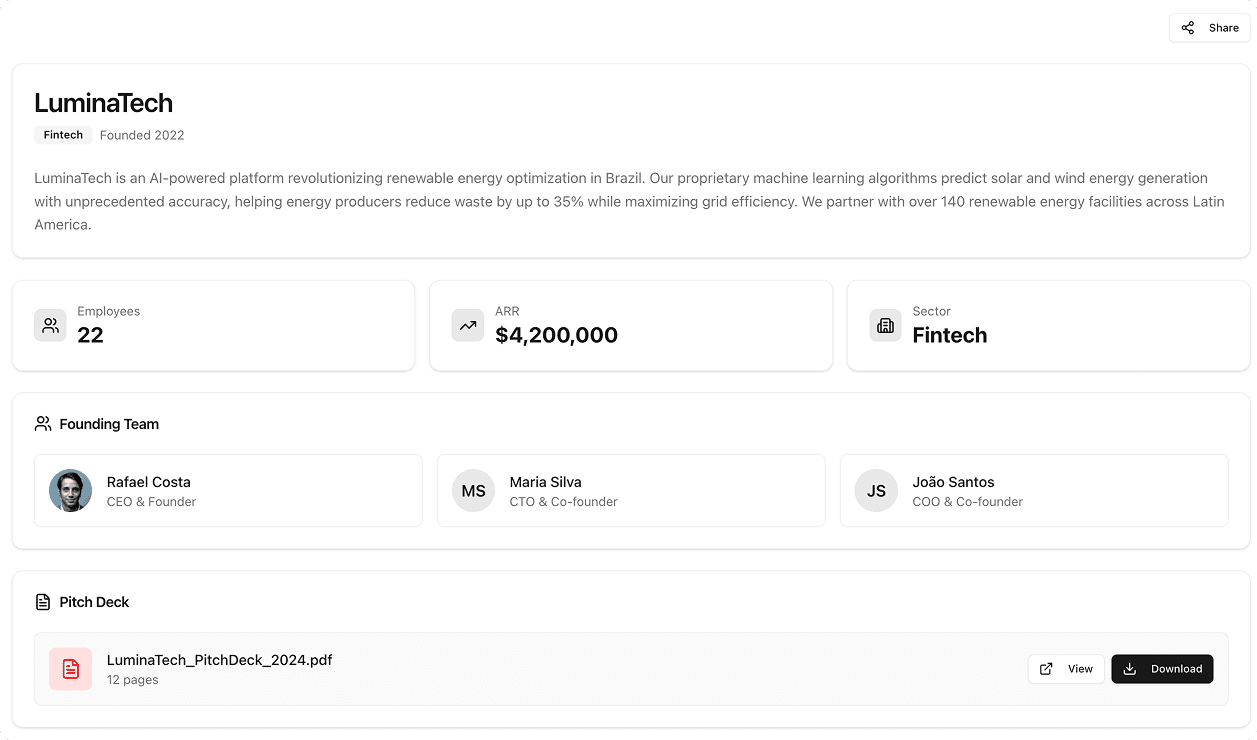

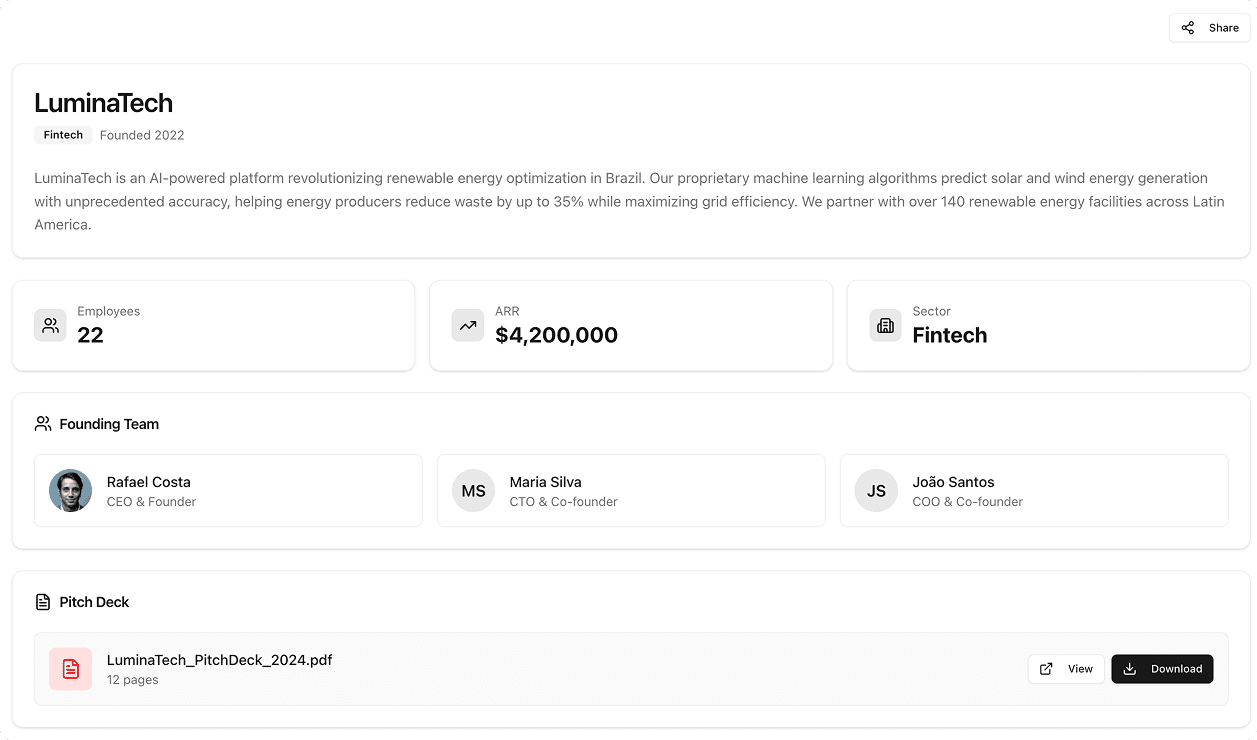

Startup Page

Share all information about your startup securely with investors in a dataroom with a built-in AI assistant for faster due diligence.

Startup Page

Share all information about your startup securely with investors in a dataroom with a built-in AI assistant for faster due diligence.

Startup Page

Share all information about your startup securely with investors in a dataroom with a built-in AI assistant for faster due diligence.

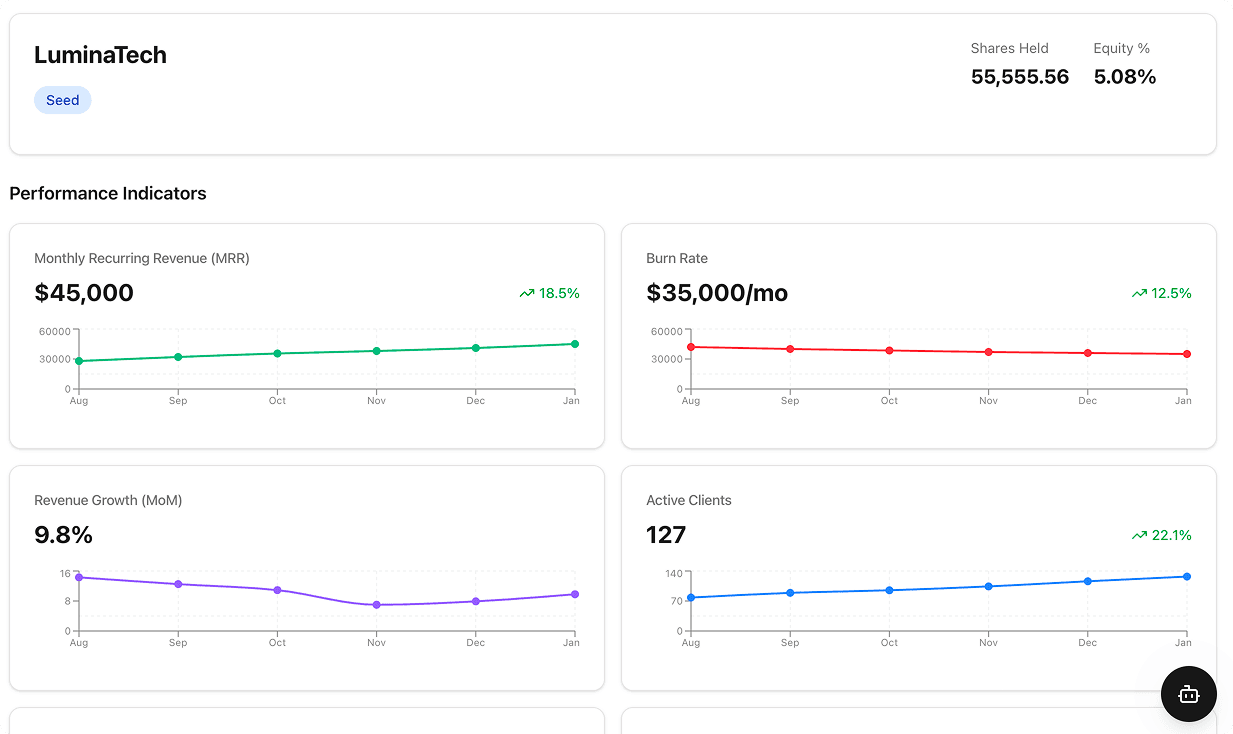

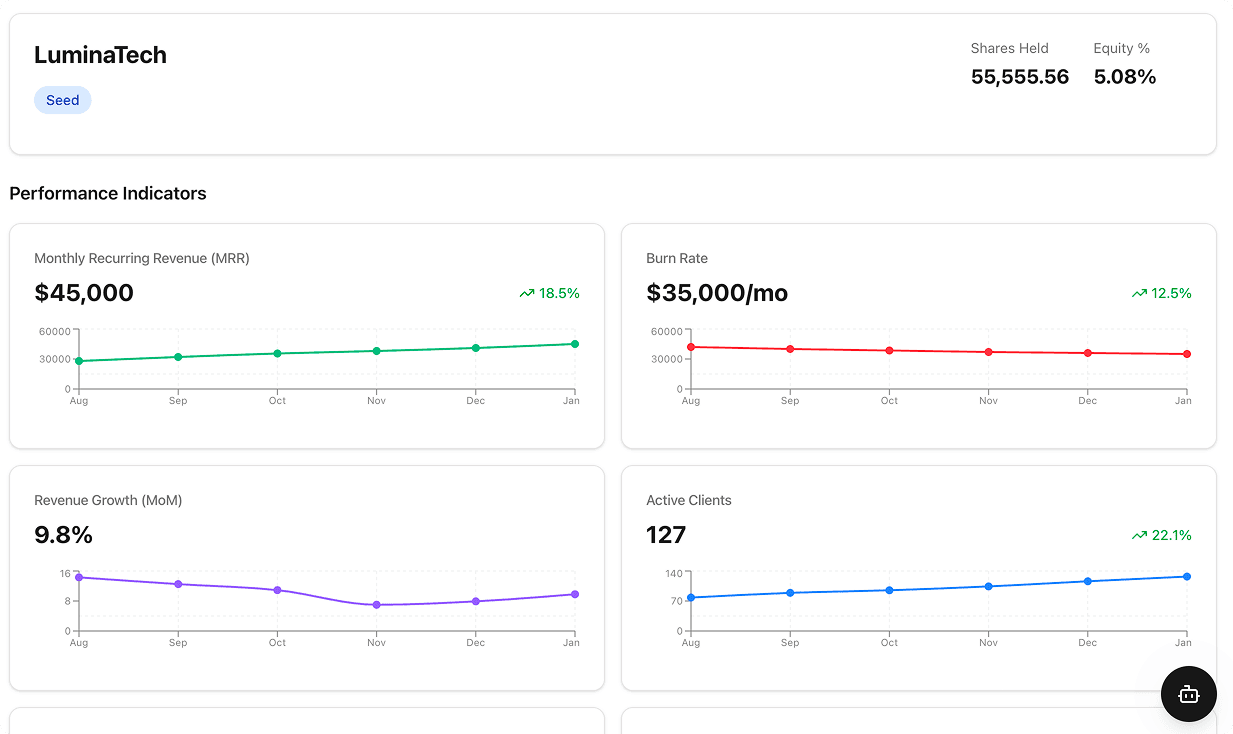

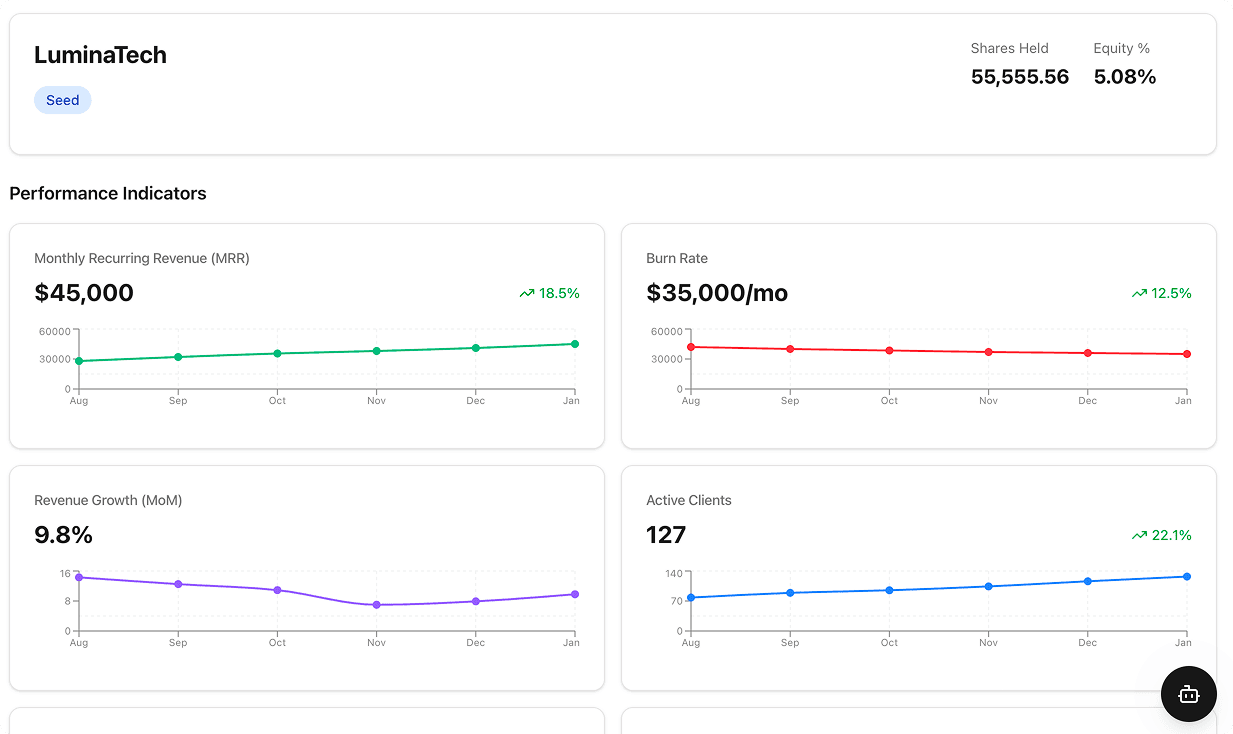

Metrics

Share key metrics about your company's performance through an investor dashboard, no more monthly emails.

Metrics

Share key metrics about your company's performance through an investor dashboard, no more monthly emails.

Metrics

Share key metrics about your company's performance through an investor dashboard, no more monthly emails.

Features

Built for simpler fundraising

Automated due diligence

Investor data room with a built-in AI agent so they can make decisions faster.

Less legal fees

Create a funding agreement using legal templates for no cost.

Integrated payments

Receive funding directly in your connected bank account.

Invite

Have investors join a funding round using a link.

KYC built in

Investors get verified when they sign up.

Full auditability

All payments and shareholders traceable in one place.

Features

Built for simpler fundraising

Automated due diligence

Investor data room with a built-in AI agent so they can make decisions faster.

Less legal fees

Create a funding agreement using legal templates for no cost.

Integrated payments

Receive funding directly in your connected bank account.

Invite

Have investors join a funding round using a link.

KYC built in

Investors get verified when they sign up.

Full auditability

All payments and shareholders traceable in one place.

Features

Built for simpler fundraising

Automated due diligence

Investor data room with a built-in AI agent so they can make decisions faster.

Less legal fees

Create a funding agreement using legal templates for no cost.

Integrated payments

Receive funding directly in your connected bank account.

Invite

Have investors join a funding round using a link.

KYC built in

Investors get verified when they sign up.

Full auditability

All payments and shareholders traceable in one place.

Why VelaFund?

Why VelaFund?

Why VelaFund?

There’s a faster way to raise funds

Other Tools

High legal fees for contracts and due diligence

Manually update cap tables with lawyers

Send monthly emails updating investors

Manual tracking of investments

Weeks to close a simple funding round

VelaFund

Zero cost templates and AI assisted due diligence

Cap tables update automatically

Dashboard for investors to track company performance

Reports generated for all investments

Close a funding round in a day

Other Tools

High legal fees for contracts and due diligence

Manually update cap tables with lawyers

Send monthly emails updating investors

Manual tracking of investments

Weeks to close a simple funding round

VelaFund

Zero cost templates and AI assisted due diligence

Cap tables update automatically

Dashboard for investors to track company performance

Reports generated for all investments

Close a funding round in a day

Other Tools

High legal fees for contracts and due diligence

Manually update cap tables with lawyers

Send monthly emails updating investors

Manual tracking of investments

Weeks to close a simple funding round

VelaFund

Zero cost templates and AI assisted due diligence

Cap tables update automatically

Dashboard for investors to track company performance

Reports generated for all investments

Close a funding round in a day

Got questions?

We’ve got answers.

01

How does VelaFund work?

VelaFund handles all your fundraising needs in one platform. You create a funding round which generates a legal contract. This gives you a link which investors use to participate in the round. Behind the scenes we manage all KYC/AML, money transfers and documentation for you so you can close your round ASAP.

02

How does this help me raise money faster?

Investors receive a link to your startup dataroom with an integrated AI agent that can answer questions about any key metrics on your behalf. We also run a judicial review and credit score check to give investors key information. This removes a process that normally requires days and legal fees to only a few hours. Investors then join your funding round by signing an agreement and transferring the money within minutes.

03

What types of investors can participate in a funding round?

The CVM only allows professional investors (individuals or entities with R$10 million in finacial investments) to participate in private placements.

04

Can I use this for crowdfunding?

No, VelaFund does not offer the creation of crowdfunding rounds where retail investors can participate. This is on our roadmap however so stay tuned!

05

How much does it cost?

VelaFund charges a fixed rate of 4% of the funding round for rounds below R$1 million. For anything above R$1 million the rate is 2%.

06

How do I receive my funds from a round?

Your funds will be held in escrow until the round expires or your fundraising goal is met. Your funds will then automatically be transferred to your connected bank account.

Got questions?

We’ve got answers.

01

How does VelaFund work?

VelaFund handles all your fundraising needs in one platform. You create a funding round which generates a legal contract. This gives you a link which investors use to participate in the round. Behind the scenes we manage all KYC/AML, money transfers and documentation for you so you can close your round ASAP.

02

How does this help me raise money faster?

Investors receive a link to your startup dataroom with an integrated AI agent that can answer questions about any key metrics on your behalf. We also run a judicial review and credit score check to give investors key information. This removes a process that normally requires days and legal fees to only a few hours. Investors then join your funding round by signing an agreement and transferring the money within minutes.

03

What types of investors can participate in a funding round?

The CVM only allows professional investors (individuals or entities with R$10 million in finacial investments) to participate in private placements.

04

Can I use this for crowdfunding?

No, VelaFund does not offer the creation of crowdfunding rounds where retail investors can participate. This is on our roadmap however so stay tuned!

05

How much does it cost?

VelaFund charges a fixed rate of 4% of the funding round for rounds below R$1 million. For anything above R$1 million the rate is 2%.

06

How do I receive my funds from a round?

Your funds will be held in escrow until the round expires or your fundraising goal is met. Your funds will then automatically be transferred to your connected bank account.

Got questions?

We’ve got answers.

01

How does VelaFund work?

VelaFund handles all your fundraising needs in one platform. You create a funding round which generates a legal contract. This gives you a link which investors use to participate in the round. Behind the scenes we manage all KYC/AML, money transfers and documentation for you so you can close your round ASAP.

02

How does this help me raise money faster?

Investors receive a link to your startup dataroom with an integrated AI agent that can answer questions about any key metrics on your behalf. We also run a judicial review and credit score check to give investors key information. This removes a process that normally requires days and legal fees to only a few hours. Investors then join your funding round by signing an agreement and transferring the money within minutes.

03

What types of investors can participate in a funding round?

The CVM only allows professional investors (individuals or entities with R$10 million in finacial investments) to participate in private placements.

04

Can I use this for crowdfunding?

No, VelaFund does not offer the creation of crowdfunding rounds where retail investors can participate. This is on our roadmap however so stay tuned!

05

How much does it cost?

VelaFund charges a fixed rate of 4% of the funding round for rounds below R$1 million. For anything above R$1 million the rate is 2%.

06

How do I receive my funds from a round?

Your funds will be held in escrow until the round expires or your fundraising goal is met. Your funds will then automatically be transferred to your connected bank account.